franchise tax board phone number live person

Share Go Back. Accessed Apr 3 2022.

We help you understand and meet your federal tax responsibilities.

. Watch Meetings Live Public Comments. He has held a number of tax positions in the wine and high tech industries and spent 5 years in the tax department of a Big 8 at the time accounting firm. In person - Free California tax booklets are provided at many libraries and post offices during the filing season.

Franchise Tax Board PO Box 307 Rancho Cordova CA 95741-0307. Wait times can be quite long if you call during the middle of the day. The board filed a suit challenging the constitutionality of the legislation.

You can also contact the California Franchise Tax Board for further questions. You can get more information from the Franchise Tax Board website. Wait times can be quite long if you call during the middle of the day.

State of California Franchise Tax Board. Office of the Governor. The suit alleged that the college enjoyed the right to contract and the government changing that contract was.

October 18-19 2022 Sacramento. Using black or blue ink make the check or money order payable to the Franchise Tax Board Write the California corporation number and 2020 Form 100 on the check or money order. November 17-18 2022 Sacramento.

Courses vary between 1 - 3 CEs depending upon the course content Intermediate-level tax topics include. Dollars and drawn against a US. September 27-28 2022 Sacramento.

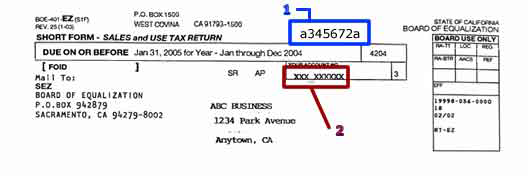

888-635-0494 Collections option 3 option 3 option 0 800-852-5711 Main taxpayer service center general questions Wait Times. A number of tax payers want the option of being able to pay with electronic check or their credit cards so we have followed the lead of the Franchise Tax Board and the Internal Revenue Service and selected a third party vendor Payment Express to accept credit card and debit card payments on our behalf and pay for all the associated fees. Employees at libraries and post offices cannot provide tax information or assistance.

Franchise Tax Board Live Chat. 2021 Guidelines for Determining Resident Status. Monday Friday 8am 5pm PT.

Start your nonprofit with 501c3 tax-exempt status in as few as 10 minutes Start your nonprofit with confidence. Make all checks or money orders payable in US. In 1816 the New Hampshire state legislature passed a bill intended to turn privately owned Dartmouth College into a publicly owned university with a Board of Trustees appointed by the governor.

Enrolled Agents and other tax return preparers are able to earn continuing education CE credit by successfully completing one of Jackson Hewitts intermediate-level tax courses. Retirement Topics - SIMPLE IRA Contribution Limits. Get your refund status.

California State Board of Equalizations Board Members Find Your Board Member. Request for Transcript of Tax Return. Virtual and In-Person Hiring Events.

If you live outside California allow three weeks to receive your order. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Find IRS forms and answers to tax questions.

Franchise Tax Board PO Box 942857 Sacramento CA 94257-0531. We recommend waking up early and calling them at 700 am. Accessed Aug 23 2022.

Over 250000 businesses created since 2015. California where he majored in religious studies. If a customer with a blanket agricultural exemption certificate on file with the retailer orders qualifying items by phone online or by mail the invoice for the transaction must show the purchasers agtimber number and the retailer must make a note on the invoice showing how the order was received ie via the phone online or by mail.

California Franchise Tax Board Contact Info. 800am 500pm Monday to Friday Pacific Time Phone.

California Franchise Tax Board Phone Number Call Now Skip The Wait

California Franchise Tax Board Linkedin

California Franchise Tax Board Linkedin

California Franchise Tax Board Linkedin

California Franchise Tax Board Linkedin